student loan debt relief tax credit application for maryland resident

To qualify you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt.

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit Valuewalk

15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000.

. Credit for the repayment of eligible student loans. T he deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming up in just over two weeks. How to apply for Marylands student loan debt relief tax credit Posted.

15 to submit an application for Tax Year 2022. Eligible people have until Sept. The following documents are required to be included with your completed Student Loan Debt Relief Tax Credit Application.

Eligible borrowers hoping to see. To apply for the. Otherwise recipients may have to repay the credit.

The credits goal is to aid residents of the Chesapeake Bay state who took out college. To apply for the credit the first important thing to note is the deadline is coming fastSeptember 15 but the application can be done online so theres still time. The application for the Biden administrations student loan cancellation promises to be a simple form according to the Education Department.

Complete transcripts from each undergraduate. 15 to apply for a. Marylands tax credit program for student loan debt relief has been in existence since 2017.

Eligible people have until Sept. 082522 Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over. August 24 2022 On Aug.

September 03 2022 0900 AM Maryland r esidents looking to claim student loan debt relief must do so in less than two weeks. How To Apply For The Maryland Tax Credits For Student Loan Relief. Eligible people have 16 days to.

Marylanders are eligible if they file their taxes have incurred at least 20000 in student. More than 40000 Marylanders have benefited from the tax credit since it. To qualify applicants must.

1 day agoIt is estimated that the online application for federal student loan relief will be available in October 2022. The applicants must also prove they used the full amount of the tax credit to pay down their student loans. Residents have until Thursday Sept.

The deadline to apply is September 15th. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. The timeline window for the debt relief application will close on Dec.

Marylanders In Need Urged To Apply For Student Loan Debt Relief Tax Credit Wbal Newsradio 1090 Fm 101 5

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Tax Credit Applications For Maryland Student Loan Debt Relief Close Thursday

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

Application Process Opens For Student Loan Debt Relief Tax Credit

Governors Leading On Supporting Student Loan Borrowers National Governors Association

Tax Credit Applications For Maryland Student Loan Debt Relief Close Thursday 24 7 Wall St

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 More Than 40 000 Students Graduates Have Received Credit Since 2017 The Baltimore Times Online Newspaper Baltimore News

Marylanders Can Apply For Some Relief From Student Loan Debt Wfmd Am

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show

Gov Larry Hogan Tax Credits For Md Residents With Loan Debt Wusa9 Com

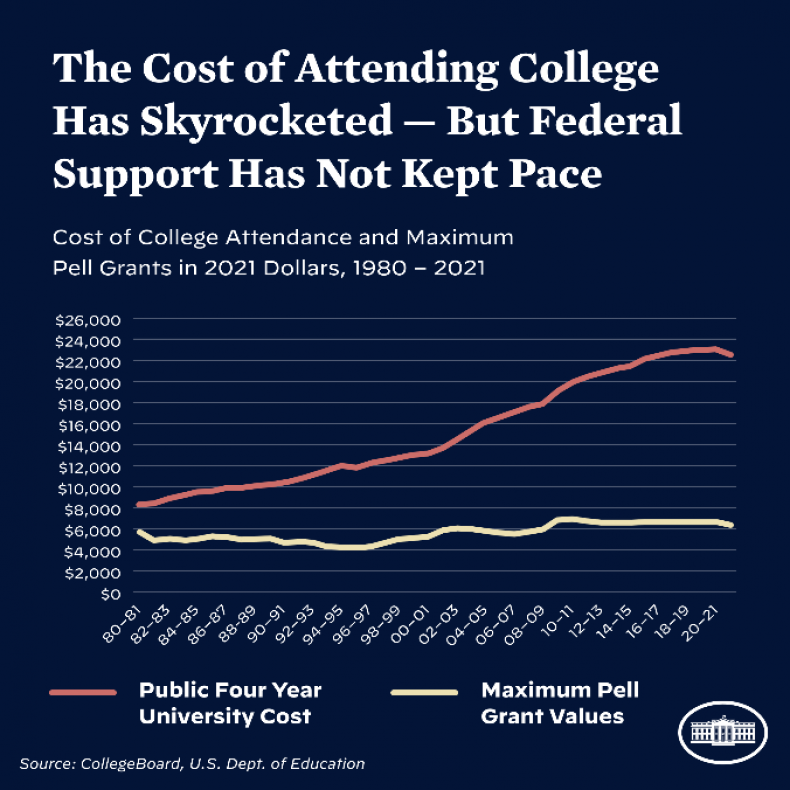

Opinion Biden S Student Debt Plan Is A Democratic Version Of Trickle Down Economics The Washington Post

Marylanders Apply Loan Debt Relief Tax

Baltimore City Encourages Residents To Apply For Homeowners Tax Credit Conduit Street

Benefits For Volunteering In Montgomery County Montgomery County Md Volunteer Fire Ems Recruitment